Heartwarming Tips About How To Repair Credit Rating

Having a bad credit score or a generally checkered past and a credit file full of mistakes or even defaults and late payments can be a real hindrance in life,.

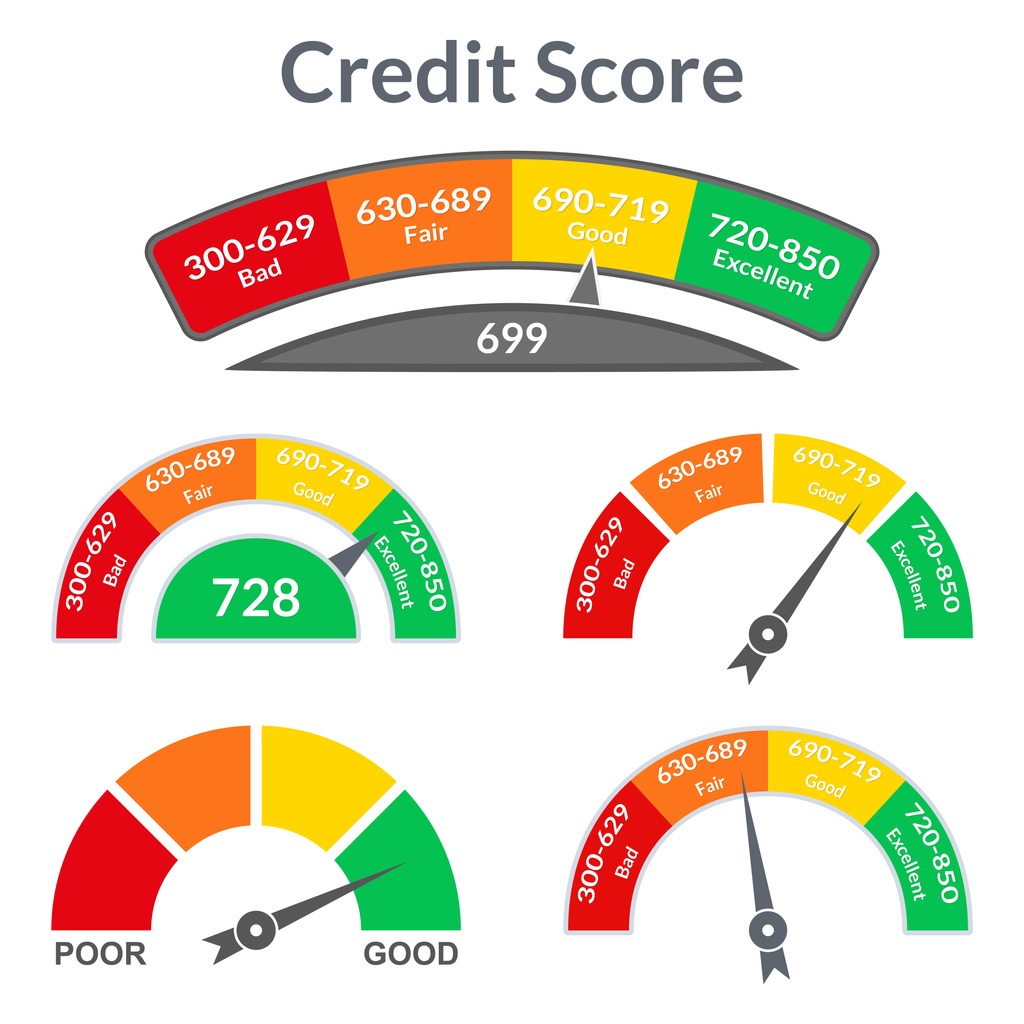

How to repair credit rating. Credit score or credit rating (where we're not talking about a score from a credit agency): For cardholders with “good” credit — a credit score of 620 to 719 — the typical interest rate charged by big banks was about 28 percent, compared with about 18. There are four main ways to get your credit score:

A borrower who finances $20,000 in private student. Ask the credit provider (such as your bank,. But that’s only one tiny part of fixing your credit score.

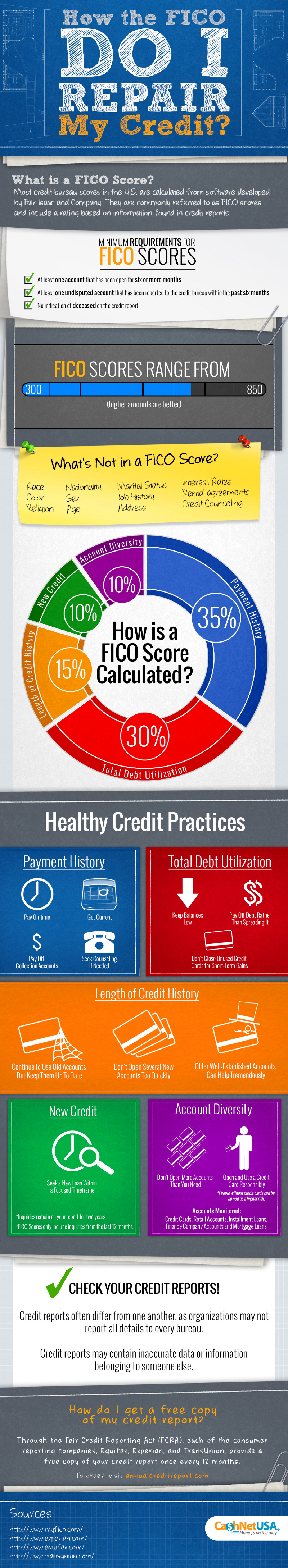

Credit repair companieswork mostly by deleting negative information from your credit report, typically errors. Here are some steps you can take to correct your credit report: Talk to a credit or housing counselor.

Check your credit or loan statements. In that scenario, the $2,000 credit for the heat pump could be combined with tax credits up to $600 total for the windows/skylights plus $500 for two or more doors. You may see ads from credit repair companies offering to fix errors on your credit report about credit products (like credit.

In this context it can also be used interchangeably in casual speak with. Check before you use a credit repair company. Contact the credit provider or credit reporting body.

You may need to build your credit fast if you're preparing to apply for credit or have struggled to qualify in the past. And you might find it faster to dispute errors yourself. Find a credit score service.