Real Info About How To Manage Currency Risk

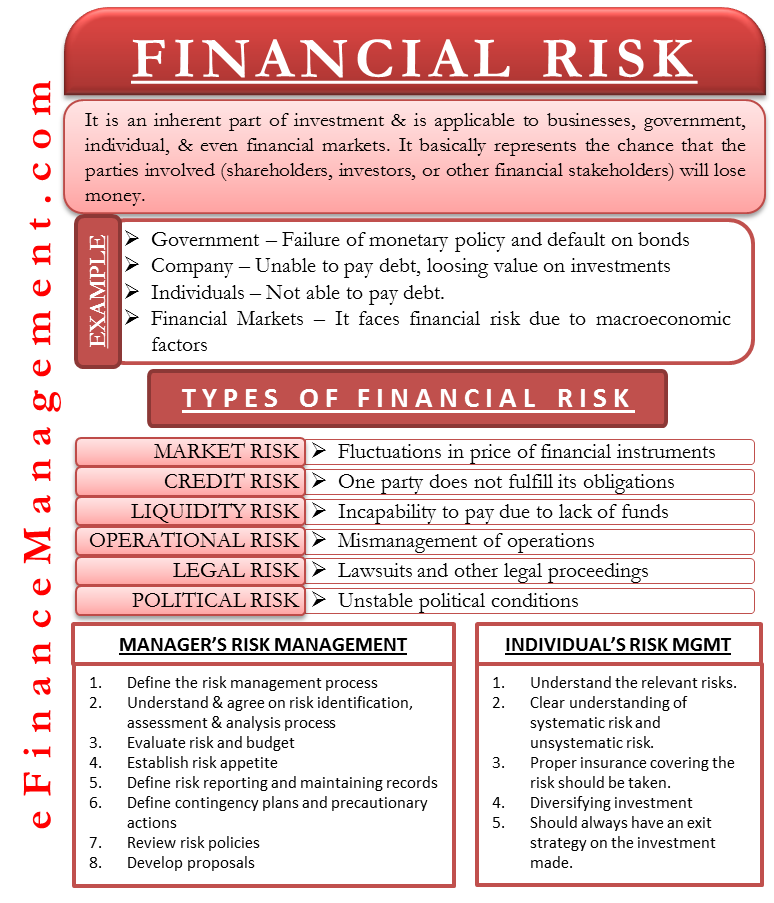

Steps to manage currency risk.

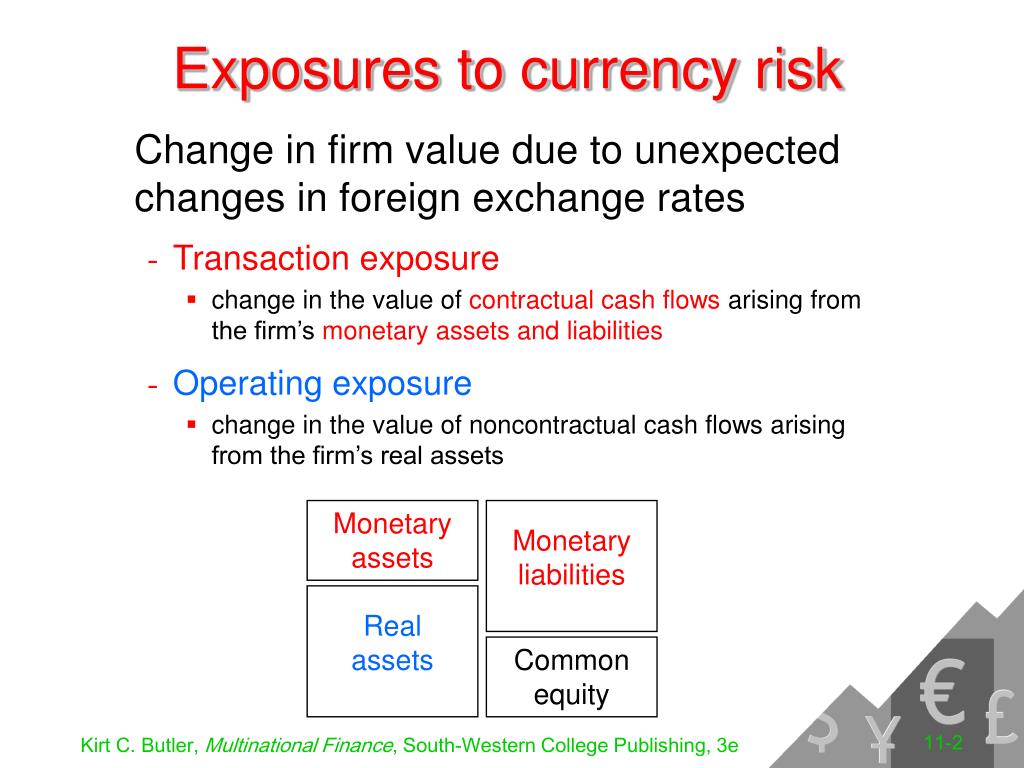

How to manage currency risk. Trade finance july 7, 2022. Ways to manage currency risk. Investors or companies that have assets or business operations across national borders are exposed to currency risk that may create unpredictable profits and losses.

What is foreign currency risk and how does it work? Written by true tamplin, bsc, cepf®. To manage foreign currency risks well you need a strategy.

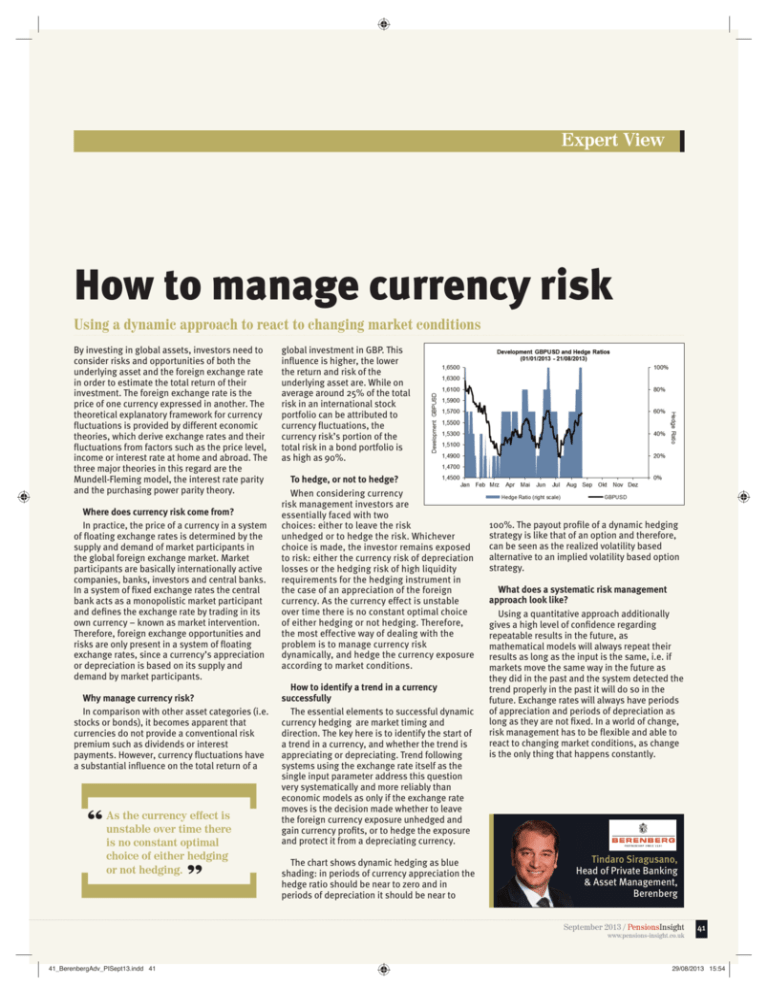

If you think currencies and exchange rates are things that only bankers and traders need to worry about, think again. Wealth management » investment risk » currency risk premium. Let’s explore some of the causes of fx risk.

While currency risk cannot be entirely eliminated, there are several strategies one can employ to manage it effectively. Hedging strategies can protect a foreign investment from currency risk for when the funds are converted back into the investor's home currency. Managing currency risk for a business can be challenging.

Picking the right currency risk management option. Currency exchange is the risk that future movements in exchange rates will have a material adverse impact on the position of your business. How to mitigate the risk of foreign exchange.

There are multiple factors which can impact a company’s exposure to currency risk and. Here’s how currency risk could hit your portfolio and ways to minimize its threat. Also known as currency risk, fx risk and exchange rate risk, it describes the possibility that an investment’s value may decrease due to changes in the relative value of the.

Decide which currency risks to manage. Try to export or import from more than one currency zone and hope that the zones don’t all move together, or if they. To avoid assuming an unacceptable degree of risk, here are some forex volatility trading tips:

In general, the following approaches might provide some help: We look at how you can do this below. (2) economic or business risk related.