Amazing Tips About How To Build Up Your Credit

Your credit score reflects your reliability as a borrower,.

How to build up your credit. Check your credit report for errors. Share jared oriel for money while building credit always requires some patience, you can get your score up quicker than you’d think with the right financial. One way to quickly increase your credit score is to review your credit report for any errors that could be negatively.

In fact, if your credit card limit is $1,000, you should not spend more than $300 to maintain your credit score, and you should spend less if you're hoping to. In that scenario, the $2,000 credit for the heat pump could be combined with tax credits up to $600 total for the windows/skylights plus $500 for two or more doors. Based on fico, the most popular credit scoring model, you can generate a credit score after six months of reported payment history.

To build credit, you need to obtain credit—and opening a credit card account can be a way to accomplish that goal. Personal finance 6 ways to rebuild credit advertiser disclosure 6 ways to rebuild credit focus on paying on time and reducing credit balances, and explore. Start by creating a realistic budget that.

Only a portion is refundable this year, up to $1,600 per child. Start by checking your credit reports, disputing. Grasping credit basics is key to financial health, acting as a trust meter for lenders.

To calculate your utilization rate, add up the total balances on all your credit cards and divide by the total of your credit limit across all cards. Find out the best ways to build credit from scratch, such as secured cards, student cards,. The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

Taking control of your finances is another fundamental step toward fixing your credit. Washington — during the busiest time of the tax filing season, the internal revenue service kicked off its 2024 tax time guide series to help. As you start building credit, your financial goals may go beyond simply getting a credit score.

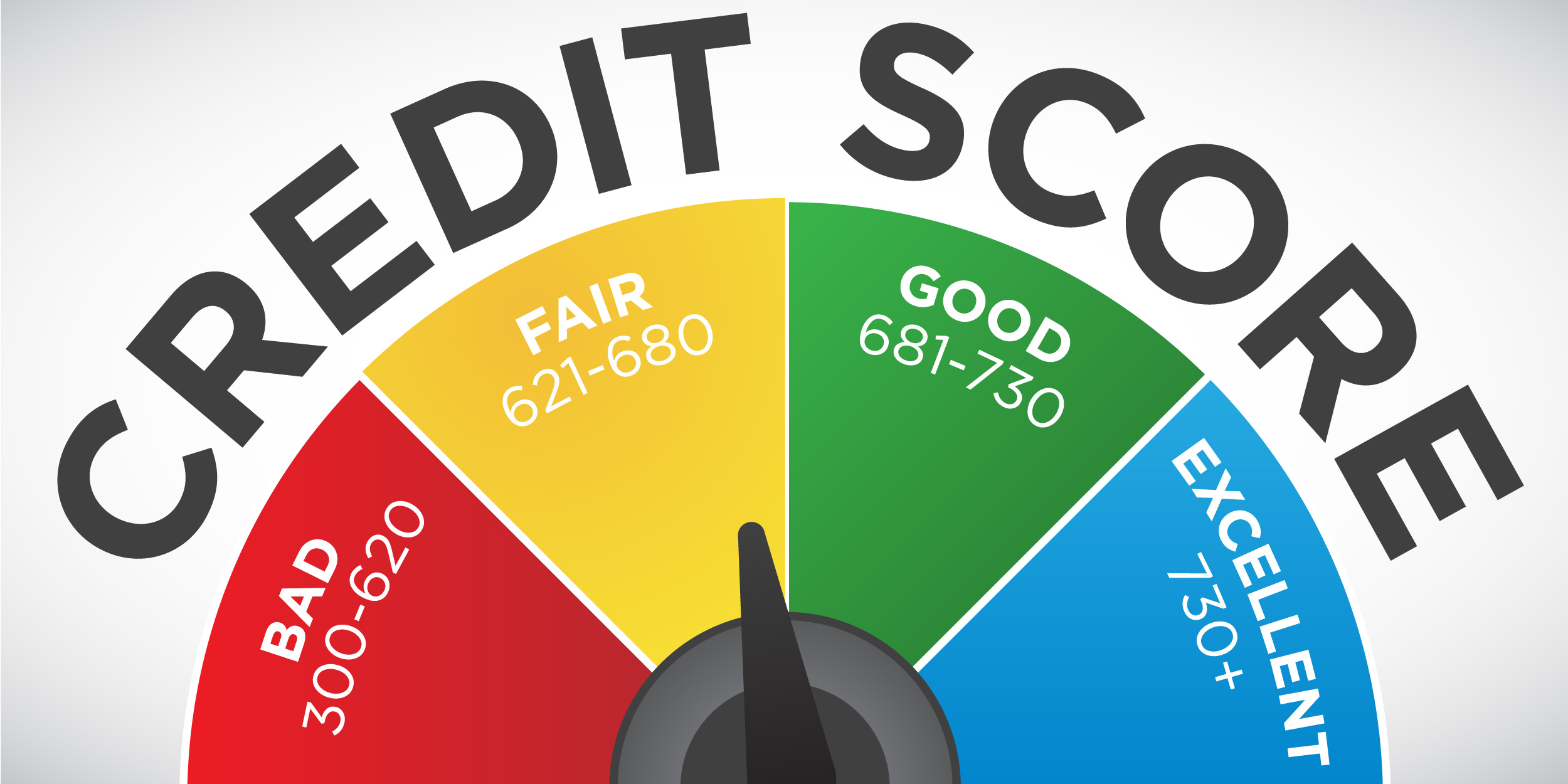

Easier to qualify for compared to. Good or excellent scores can help you qualify for the best offers. Learn how to establish and improve your credit score with expert tips and strategies.

Develop a budget and stick to it. Learn how to improve your credit score and overcome past financial setbacks with four simple steps. Here are the ranges experian defines as poor, fair, good, very good and exceptional.